Weekly Journal

Trading ideas and portfolio tracking. Part IV.

Trading is a risky activity. If you follow anything written in the article, you are responsible for the results. The result of this article may be decreased deposit and lost funds. By reading below and making any actions, you agree with our Disclaimer, Policies, and Risk Warning.

Hi everyone! Once again we issue our weekly journal. This time we will come back to futures and consider interesting macro ratios. Let's start!

Futures positions

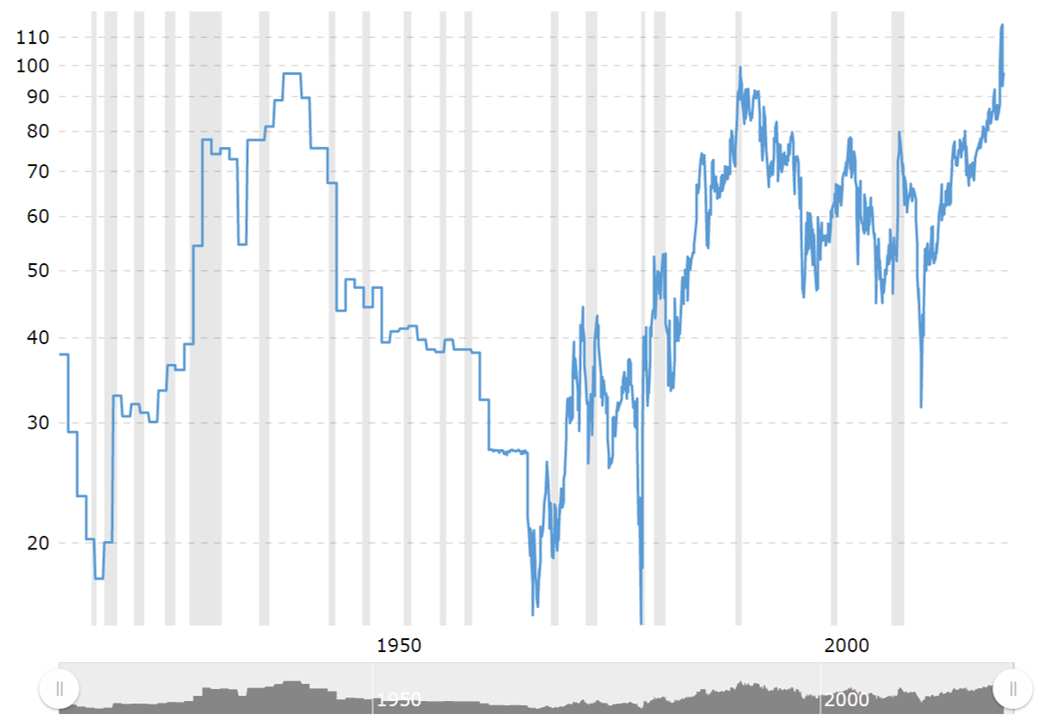

This week, we will take a look at a new platform, which is called Macrotrends. It's a great free informational resource where you can track many interesting fundamental ratios. In particular, I'd like to pay your attention to two of them - Gold to Oil ratio and Gold to Silver ratio. First of all, let's take a look into the charts below.

Gold to Oil ratio from Macrotrends.net

Gold to Silver ratio from Macrotrends.net

What do we see here? We see an extremely long-term mean-reversion tendency. In fact, I'm not a big fan of mean-reversion - markets attract so much attention not because they are mean-reverting, but trending. However, in terms of fundamental ratios, I do believe mean-reverting is a good strategy.

On the charts above, we see that right now both ratios broke their all-time highs and exceeded them by a substantial percentage. It means, that current ratios do not reflect the normal conditions (given COVID-19, it's not surprising). What we can do with this? Well, there are two things - we can either trade the ratio itself or we can extract the information from it in order to find something interesting. Let's consider the first option.

If we talk about trading ratios, we must take a position in two instruments at the same time holding proper sizes. For example, to short Gold-to-Oil ratio, you need to buy 1 Oil futures and sell 10 Gold futures because oil futures include 1000 barrels of oil, while gold only includes 100 ounces. It's a low-risk strategy that is, on a fundamental level, has some attributes of an arbitrage strategy. That's good. However, the strategy requires an extremely big margin to maintain the positions while providing only mediocre returns. From this point of view, I don't like it. Once again, I'm a risk-seeking person, so I prefer the second option.

In the second option, we decide on what we want to do based on the ratios and decompose the possible position into separate legs (when you have long and short positions as a part of a bigger strategy - positions are often called legs). Then we choose the most interesting and promising leg. It may sound complicated, but once we go through all the steps, it will be clear. So let's start.

First of all, both ratios, tell us that the gold price is really high comparing to other commodities. So, the key message from the charts is that gold is relatively overvalued. What does it mean? It means gold may fall, or gold may grow slower than oil and silver. Good, let's move to the next point.

Which ratio is more interesting? I'd say it's Gold-to-Silver ratio, because Gold-to-Oil ratio already had a big correction. So, I'm going to move forward with Gold-to-Silver ratio, and, thus, we are left with two options - we can either sell gold or we can buy silver.

What do I do next? If you read our journal from the very beginning you know that I use CoT reports a lot. This analysis is not an exception. When I check CoT reports, I see that Gold producers (the most informed group of traders) have a large negative net position. The position decreased a little bit during the Coronavirus outbreak, but still remains suggests long-term decrease.

Gold CoT Chart from Barchart.com

In terms of Silver, we see that producers increase their net negative position, so it means they think the price is high right now. In this case, I'm already more bearish than bullish. Let's consider the final piece of information - the price charts.

In terms of silver, we see a beautiful downward channel with the price being at the upper boundary with a bearish engulfing candle pattern. Seems like a perfect entry for me. However, the ratio tells us that decrease in Gold is supposed to be bigger. So, let's check the gold chart as well.

Silver chart on TradingView

On the gold chart, we see extreme volatility during several weeks and some long-forgotten resistance. On a fundamental level, gold may fall because economies are slowly opening again, and the crisis seems less probable now. So, I like all the arguments for opening a short position in gold. Honestly speaking, I like the silver chart more, but since the ratio doesn't actually give us an option to short the silver, I'll short gold.

Gold chart on TradingView

I'm not sure about the entry price yet. Gold decreased a lot on Friday, and I believe some short-term retracement is possible, so I'll monitor the market and enter either at breakout from a rectangle you see below or at retracement to $1'730 or something like that. In terms of stops and targets. The stop will be about $1'810. The first target is $1'550, the second target is $1'380.

To sum up, we have a new potential position - short Gold. With this in mind, let's consider our current portfolio.

Position and Results

This week was volatile. Japanese Yen and Hertz had the biggest moves. Japanese Yen is getting closer to our target of 0.00901. And Hertz... Well, this stock worths a separate paragraph.

I'm still not sure why Hertz surged more than 100% on Thursday and Friday - two days of heavy net buyings. Such upward swings usually hint on some correction ahead, and, as Perry Kaufman said, when markets give you big profits in short periods of time take it and run. Besides, heavy buyings came from retail investors. (here is the article about Robinhood accounts HTZ statistics) And this is another bad news - retail investors can panic easily, so if the price starts falling, it can cause a massive sell-off.

On the other hand, there was a multi-day island reversal on heavy volume (even though it came from retail investors), and all the articles I see now about Hertz state: "DON'T BUY HERTZ". That means it is still a good time to hold Hertz. Those who watched Psychology course know, that contrary opinion can sometimes work out pretty well.

Bottom line - I will pay a lot of attention to HTZ during the next week. I still don't want to sell but I may consider scratching position if price drops to $0.8 in a volatile move.

Instrument

ZC (Corn)

6J (Yen)

UA

COTY

HTZ

GC (or MGC)

Position

+1

-1

800

200

3000

Entry Date

May 18

May 18

May 26

May 27

May 26

Entry price

321 1/4

0.009333

7.7

4.62

0.79

Open P&L

$562

$2'616

$1'776

$96

$6'270

P&L

Last time, I promised to add the equity curve for our positions. Unfortunately, I won't give you an equity curve, but instead, I will provide you with a P&L curve. Why is that? Well, it's easy to create an equity curve for the stock positions and the total deposit. Since we have stock and futures positions and these are not the only positions I hold in my account, we cannot build an equity curve (since I don't know which portion of capital is "reserved" by futures position). Of course, we can say that for futures positions, we will use the initial margin, but that is not true - that would be too risky. In fact, in complex portfolios, the amount of capital that you use as a margin varies with the time. For example, this week, I opened several more futures positions, and margin for Japanese yen and Corn dropped (since the deposit is now divided among the bigger number of futures positions). So, hope P&L curve will serve just as well.

The P&L curve of Sharpedge Weekly Journal Portfolio since May 17

Hope you enjoyed the journal and see you next week!